Viewpoints

Insights from Fabrica Ventures Team.

November 18, 2023

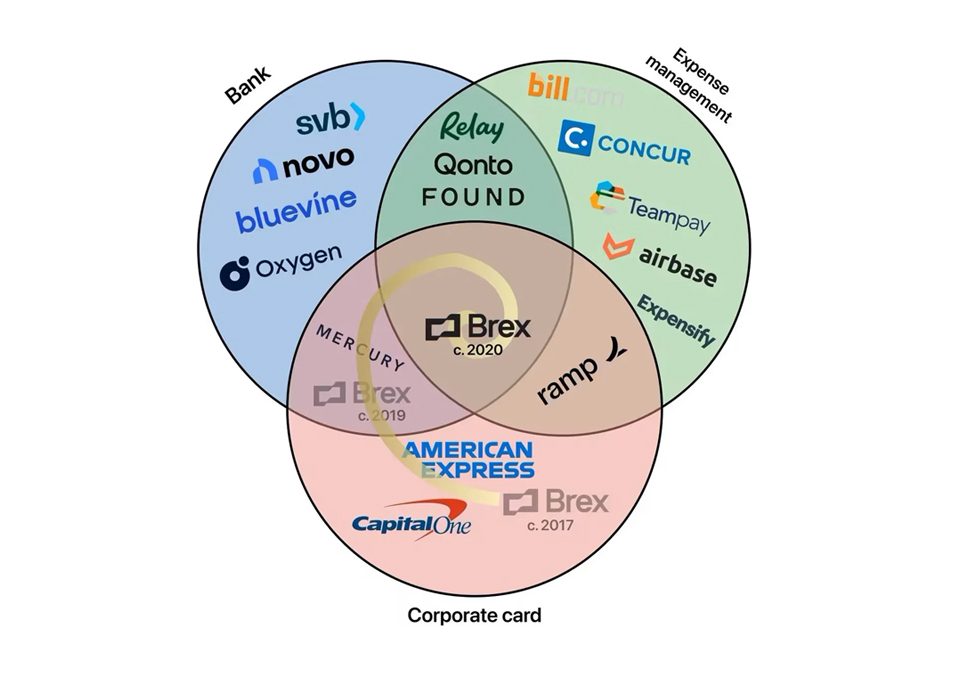

Historically, startups’ founders faced difficulties when attempting to open bank accounts and get credit cards, especially without offering a personal guarantee. In 2018, Brex changed this […]

November 11, 2023

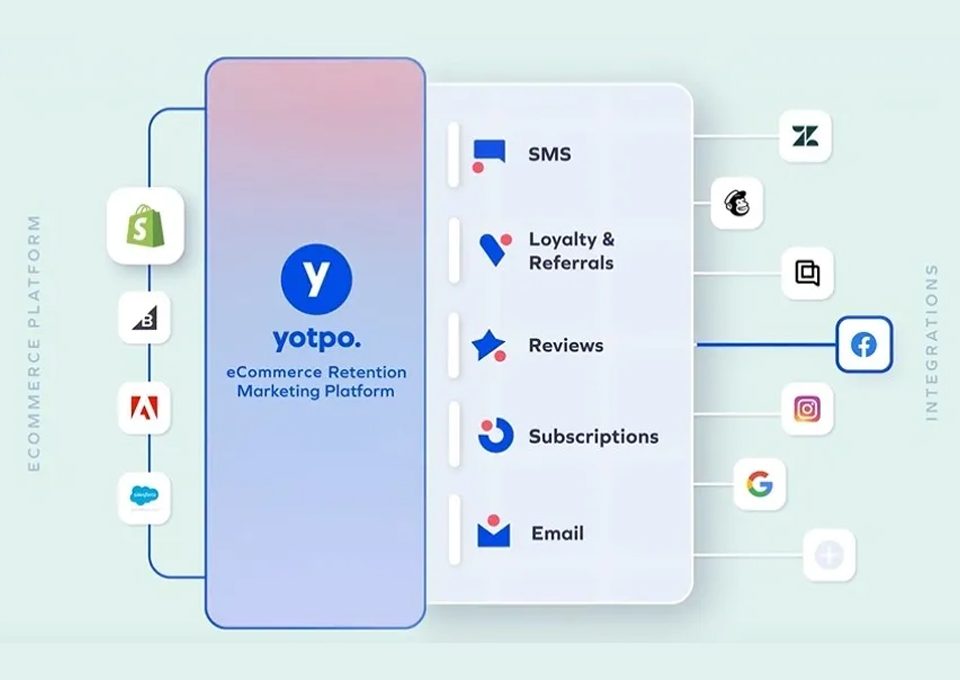

Nowadays almost every company needs an online store. Needless to say, ecommerce is huge and the sales’ migration to digital is inexorable. Ecommerce platforms such as […]

October 22, 2023

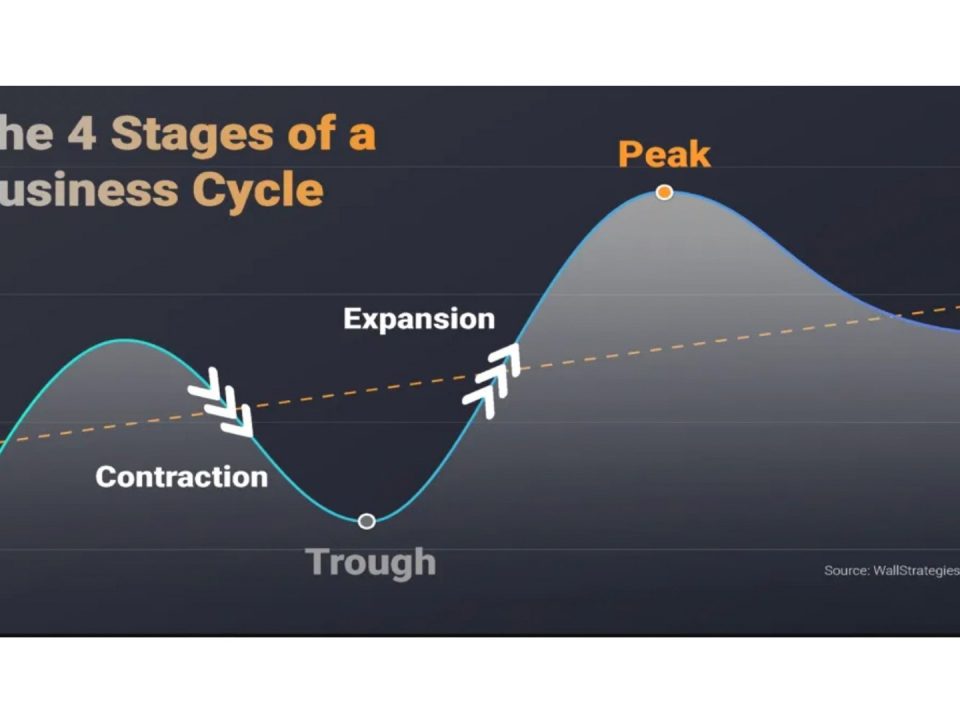

Today we would like to share the following article from Crunchbase: The Window Is Closing For LPs To Earn Their Place In History. We, that are immersed […]

October 15, 2023

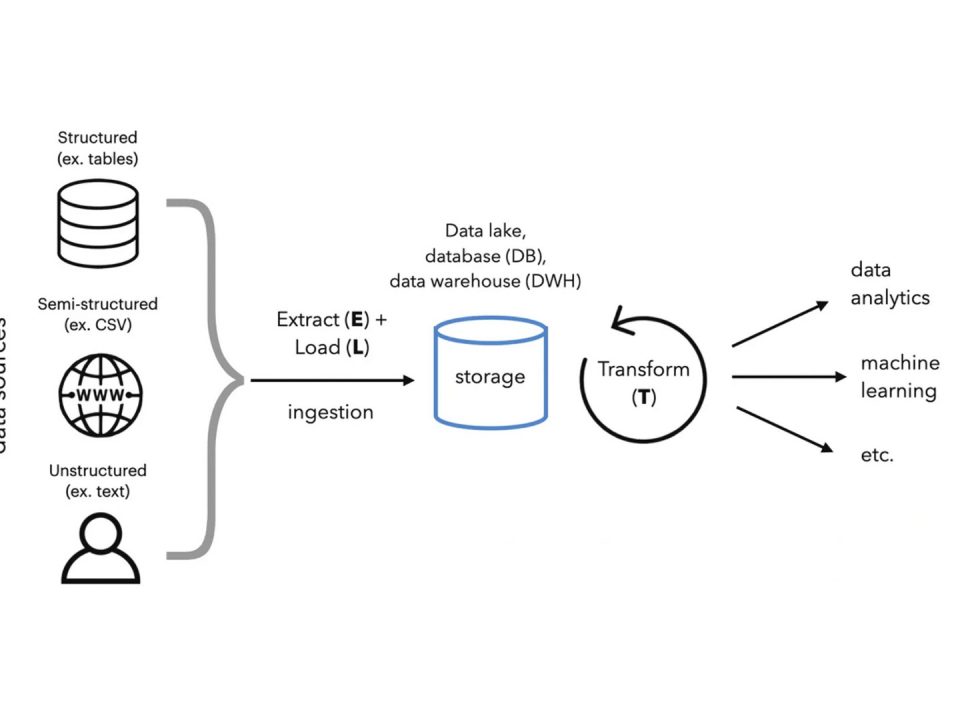

In the beginning: OLTP (Online Transaction Processing) OLTP emerged several decades ago to make possible the development of interactive experiences for customers. Prior to the OLTP, […]

October 8, 2023

Oil was considered a waste before people understood what it was. Once people understood the economic potential of oil, it was transformed from unwanted waste into […]

October 1, 2023

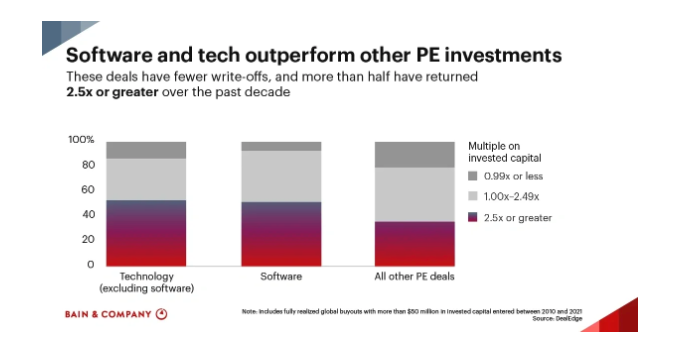

PE funds are spending record amounts of capital on take-private enterprise-software companies. Citrix ($16.5B), Qualtrics ($12.5B), Anaplan ($10.7B), Zendesk ($10.2B), Avalara ($8.4B), Coupa ($8.0B), SailPoint ($6.9B), […]

September 22, 2023

The tech IPO window has been fairly closed for the last 18 months. Klaviyo has just shattered it in a remarkable way – the company was […]

September 16, 2023

Arm, a chip-designer, IPOed past Thursday with its shares jumping by 25% in its first day of trading reaching a market cap of $85B. Fueled by […]

September 3, 2023

In every era automation has propelled us forward. And wow! That was our feeling when we first saw Workato’s automation software, which has recently become a portfolio company […]