Klaviyo’s Remarkable IPO

September 22, 2023

The Modern Data Stack

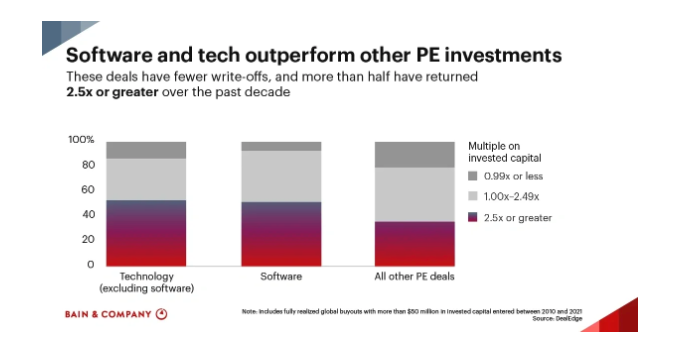

October 8, 2023PE funds are spending record amounts of capital on take-private enterprise-software companies.

Citrix ($16.5B), Qualtrics ($12.5B), Anaplan ($10.7B), Zendesk ($10.2B), Avalara ($8.4B), Coupa ($8.0B), SailPoint ($6.9B), New Relic ($6.5B), Cvent ($4.6B), KnowBe4 ($4.6B), Duck Creek ($2.6B) are just a few examples of PE take-private enterprise-software deals that happened since 2022.

So, why do PE funds are purchasing publicly traded enterprise-software companies to take them private?

1. Lower Valuations: every market goes through peaks and troughs cycles, and now software multiples are down in the curve

2. Growth Potential: software in projected to remain the fastest growing sector in the US economy – moreover, recent advances in areas such as AI (which promises exponential growth opportunities) are still in their early stages

3. Global Scalability: software can be scaled up globally

4. Recurring Revenues and High Gross Margins: enterprise software produces recurring revenues, high gross margins and usually do not require substantial capital expenditures – in addition, it is often one the last services that businesses turn-off during tough periods, creating revenue stickiness (differently from consumer services that are usually impacted by discretionary and transitory spending decisions)

5. Efficiency Prioritization: In tight economic times, businesses tend to prioritize efficiency and one way to achieve this is deepening enterprise-software utilization

Conclusion

Enterprise-software is really a unique asset class.

Some PE funds have sensed the present opportunity of taking enterprise-software companies private and are investing heavily.

Fabrica Ventures has also sensed the depleted enterprise-software multiples window in the VC secondary market.

Navigating the tech cycle is a game of patience; our LPs are patient and understand the importance of setting aside a part of their savings to generate long-term alpha-returns.