Viewpoints

Insights from Fabrica Ventures Team.

March 18, 2023

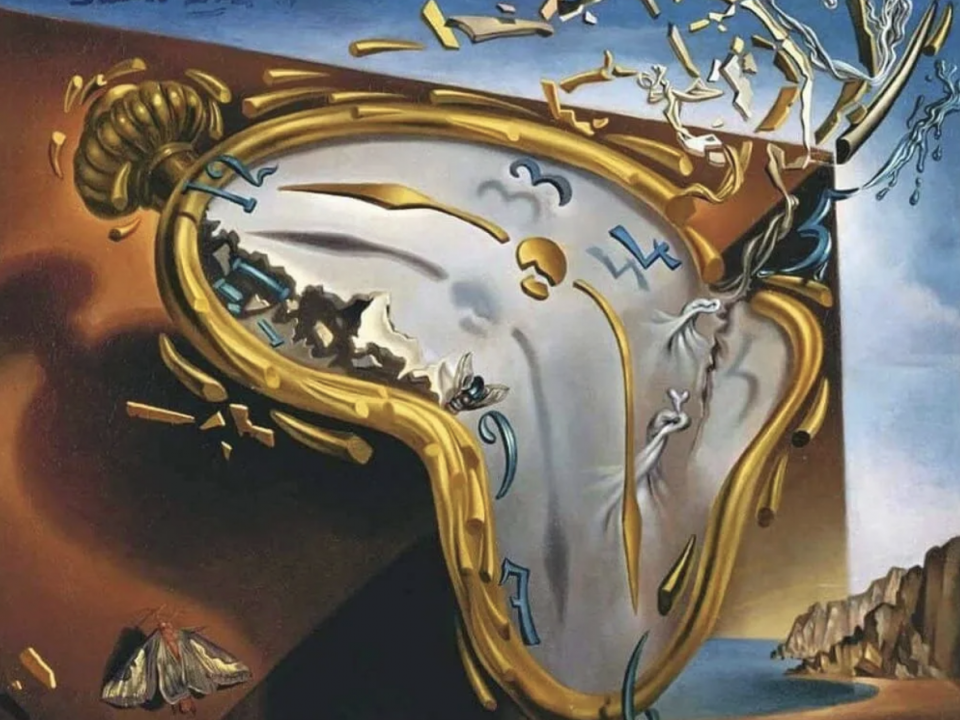

Capitalism has been gone a long time ago with the end of the gold standard (to the fiat standard), the development of the banking fractional reserve […]

March 5, 2023

We have written extensively about why startups are staying private longer and how it represents a wealth generation shift from public to private markets. Besides market […]

February 14, 2023

Doug Leone was the Sequoia Capital’s managing partner that led its expansion to China and India. In an interview at Stanford in 2014, “Luck & Taking […]

February 4, 2023

“Originating from Greek mythology, and much of Roman mythology, Centaurs symbolize masculinity, and are supposed to be brave, loyal warriors”. When the term unicorn was coined […]

January 29, 2023

Stripe provides the infrastructure for merchants to accept all major forms of digital payments online as well as POS payment solutions. Stripe’s comprehensive product suite and […]

January 20, 2023

Howard Marks of Oaktree Capital has deservedly become a financial guru (plus a billionaire). His memos to Oaktree clients are always memorable. Several parts of his […]

December 29, 2022

Some definitions first: A primary transaction happens when securities are issued and sold directly by a company, while a secondary transaction is when the initial purchaser of a security sells […]

December 16, 2022

Forecasting is a futile exercise since human action is driven by randomness. Nevertheless, given the Fed’s ongoing interest rates hiking and monetary tightening, a recession seems […]

December 11, 2022

All figures from PitchBook. Insider-led rounds (ILRs) are defined as new financings for startups that are led by existing investors. In 2022 YTD (up to November […]