Yotpo – Thinking Small (Ecommerce) to Scale Big

November 11, 2023

The 2024 Tech IPO Pipeline

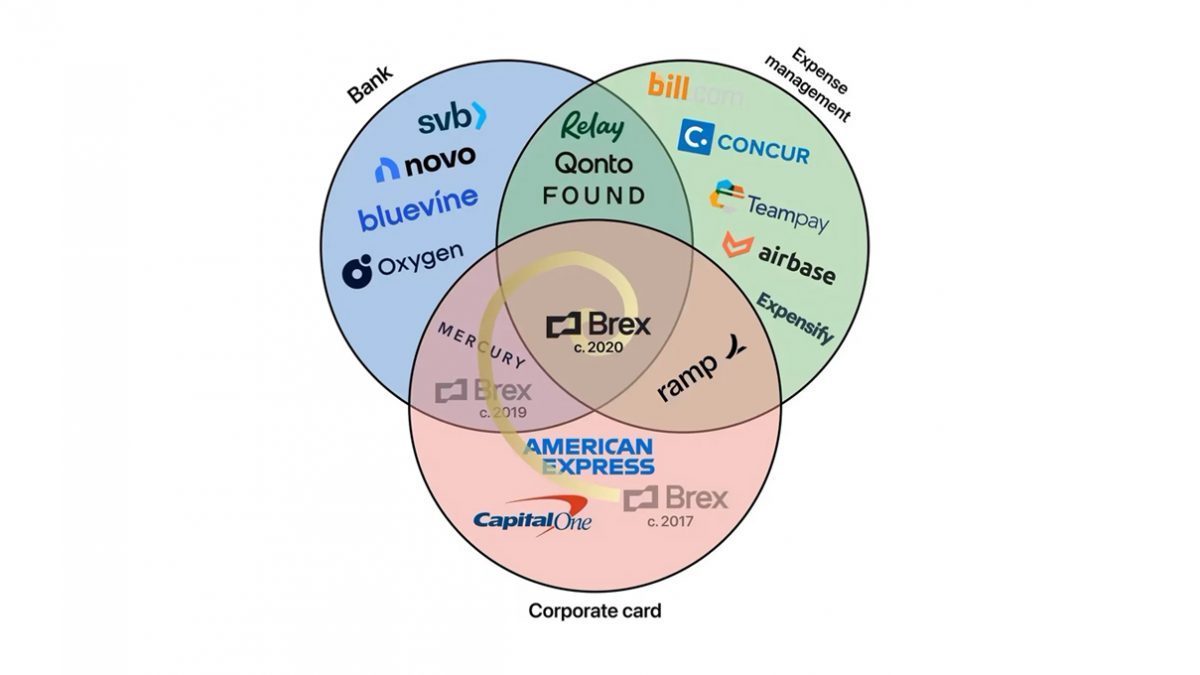

November 25, 2023Historically, startups’ founders faced difficulties when attempting to open bank accounts and get credit cards, especially without offering a personal guarantee.

In 2018, Brex changed this landscape by introducing a startup credit card that assessed the cash in the bank rather than relying on historical financials.

With a credit limit many times that of Amex and no need for a personal guarantee, Brex enabled newly formed startups to rapidly obtain corporate cards by connecting their bank accounts (through Plaid), eliminating the cumbersome process of filling out paper forms and waiting for weeks for approval.

Unlike Amex, Brex provided corporate cards for free and included startup-centric perks such as AWS credits. The monetization strategy involved capitalizing on transaction volume through interchange fees: ~2%, with ~50% gross margins.

Despite low switching costs and entry barriers, Brex leveraged its impressive top-line transaction volume (over $25B in 2023), substantial gross revenue, and rapid growth rate (it took Brex less than 2 years to reach the $100M ARR mark) to attract venture capital and talent, positioning itself to consolidate the entire finance stack.

Indeed, Brex’s product-line is now composed of:

Corporate Cards: Brex’s core product with high credit limits for startups without any monthly or set-up free.

Brex Cash: A cash management account where companies can hold their funds to earn interest and make ACH/wire payments. Brex parks the funds with its partner FDIC-insured banks.

Brex Empower: Spend management software, tightly coupled with corporate cards, through which companies can build rule-based spending workflows, reimburse employee expenses, and review purchases.

Bill Pay: Payment software for non-payroll, non-employee expenditures where companies can process invoices and pay their vendors digitally instead of manually processing invoices.

Conclusion

In October 2021, Brex raised $300M at a $12.3B valuation making it the most valued startup ever founded by Brazilians – Ribbit Capital (who led Nubank’s private journey) is the leading investor.

The scale of the opportunity is huge; $25T in B2B payments are transacted each year in the US alone, and only 4% is spent on corporate cards.

In order to get a slice of this opportunity, Brex has become a Fabrica Ventures Fund II portfolio company.