Brex, at the Center of the Venn Diagram of Neobanks

November 18, 2023

LTV-CAC Ratio

December 2, 2023I recently had a conversation with a Nasdaq executive who mentioned that there are over 150 tech companies with their S-1 IPO applications filled out, just needing updates.

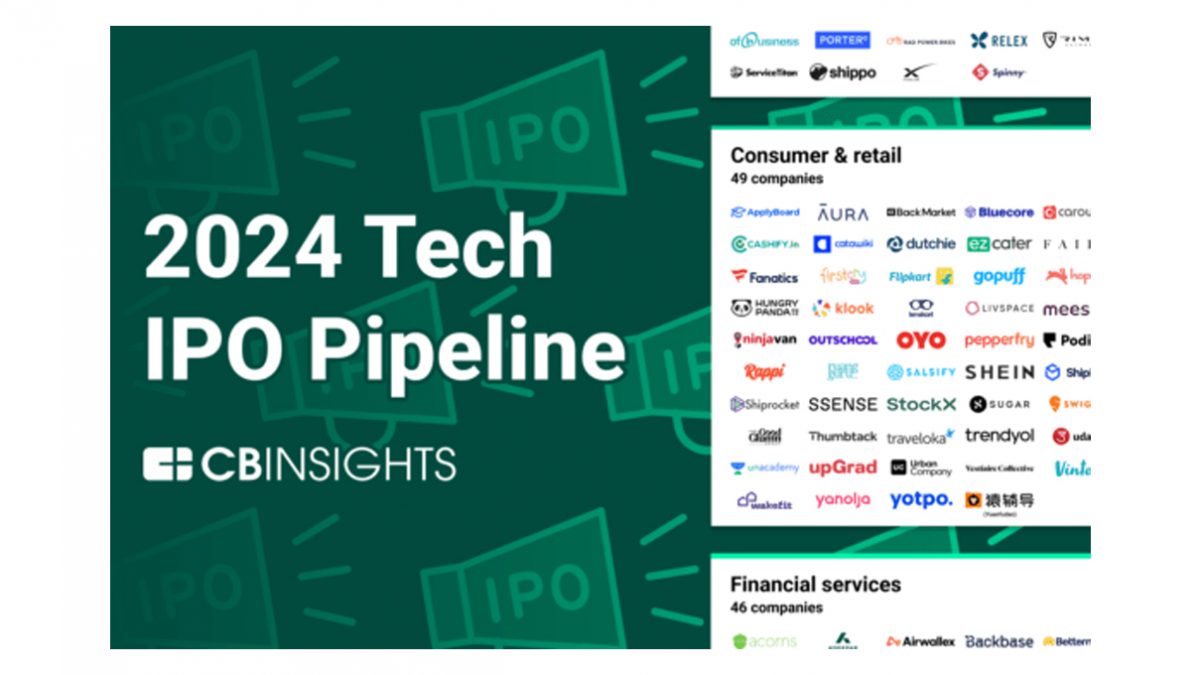

Indeed, several speculative lists of potential candidates for IPOs are often published. Below, I highlight the most recent IPO pipeline from CB Insights:

“As the IPO market creaks open again, these are the 257 companies we think could hit the public markets next.

September brought a wave of relief to the tech world. Frozen shut for a year and a half, the IPO market finally seemed to be thawing, with 3 major tech players — Arm, Instacart, and Klaviyo — making their public debuts.

However, their post-IPO performance has been mixed at best. All 3 companies reported underwhelming results during their earnings calls this month, and each has seen its share price stay flat or decline since its debut.

While the tepid performance could push back other tech players’ IPO plans, there is still a large pool of potential IPO candidates waiting in the wings. They can’t wait forever — especially as late-stage venture capital dries up. The pressure will likely force the IPO window further open in 2024, even if the market conditions aren’t perfect.

CB Insights is releasing the 2024 Tech IPO Pipeline, a list of 257 venture-backed companies that are likely to be weighing up going public in the next 12 to 18 months. Our analysis is based on a range of signals and datasets, including total equity funding (and how soon each company may need fresh capital), valuation, employee headcount, Mosaic score, stage of investment, and the year each company was founded.

We also looked at key people hires to identify companies that recently brought on a CFO with previous IPO or public-company experience — a sign they may be getting their financials in order ahead of the scrutiny that comes with being a public company.

Depending on market dynamics, it’s possible that many of these 257 companies will not end up going public — and those that do may not be strong performers. We are not trying to pick stock-market winners, and this list should not be viewed as investment advice.

Instead, we focus on the companies that may be ready to go public — or could have few better options than to do so — based on the signals and data mentioned above.”

Conclusion

There were 1035 IPOs on the US stock market in 2021, a record (up from 480 in 2020). Thus, CB Insights’ pipeline list of 257 companies does not look overstated since a monthly pace of ~10 IPOs does not appear exceptional under “Normal Temperature and Pressure Conditions” — and mainly after a two-year drought period.

The good news is that there are 15 Fabrica Ventures portfolio companies in CB Insights list:

Addepar, Automattic, Brex, Checkr, Fourkites, Intercom, Menlo Security (under RoFR), Netskope, Outreach, Spoton, Rubrik, Tanium, Thoughtspot, Yotpo and Workato.

Let’s see what 2024 will bring to the tech IPO market.