Fabrica VC

Insights from Fabrica Ventures Team.

June 18, 2023

There are now 650+ US based unicorns with a total valuation of over $2.0T (CB Insights). Moreover, according to Carta, the annual value of US VC […]

June 10, 2023

Pitchbook just published the global fundraising numbers for the 12-month period ending in March 2023. Fundraising was down across most private investing strategies (strategy; capital raised; […]

May 28, 2023

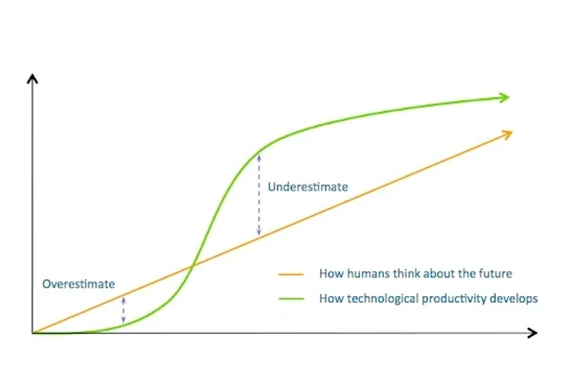

Since 2022 the US VC market, in all stages, has clearly shifted to become investor friendly. With one exception, though: AI startups are commanding bull-market prices. […]

May 20, 2023

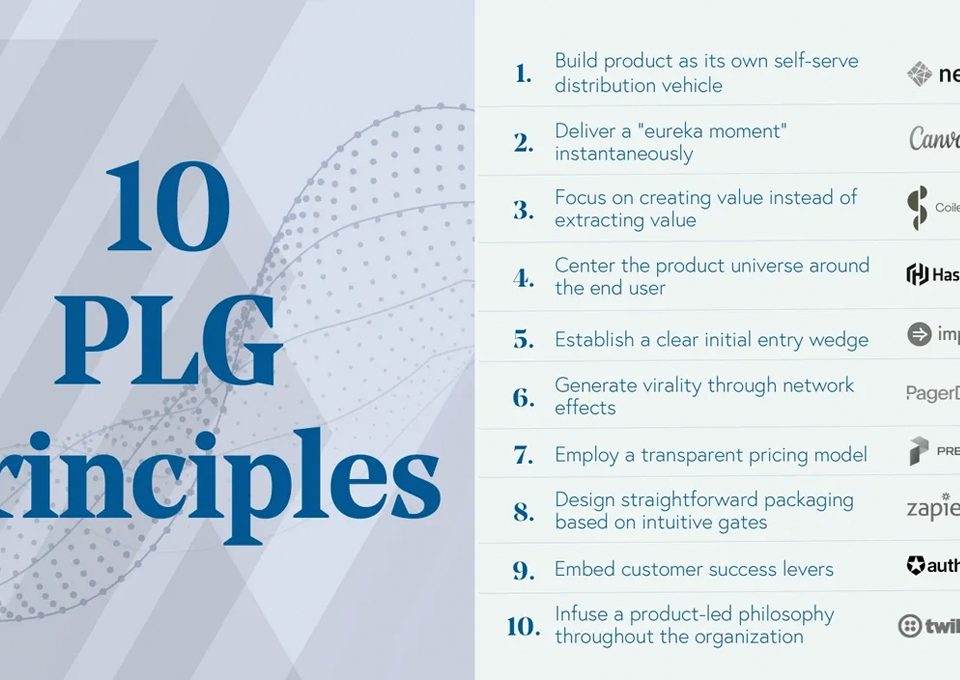

What could be the best possible go-to-market model for a software startup? If a startup can build a software that users love and get immediate value […]

April 29, 2023

I attended the recently held (April 22-24) Brazil at Silicon Valley conference. It was very enjoyable and entertaining to be together with more than 500 Brazilian […]

April 20, 2023

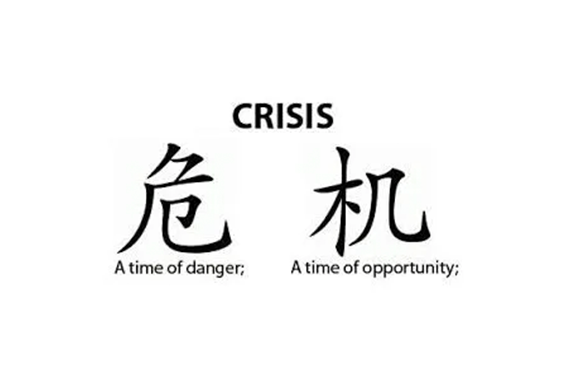

“The time to buy is when there’s blood in the streets” — Baron Rothschild It seems obvious, but it is against human psychology. It does not […]

April 15, 2023

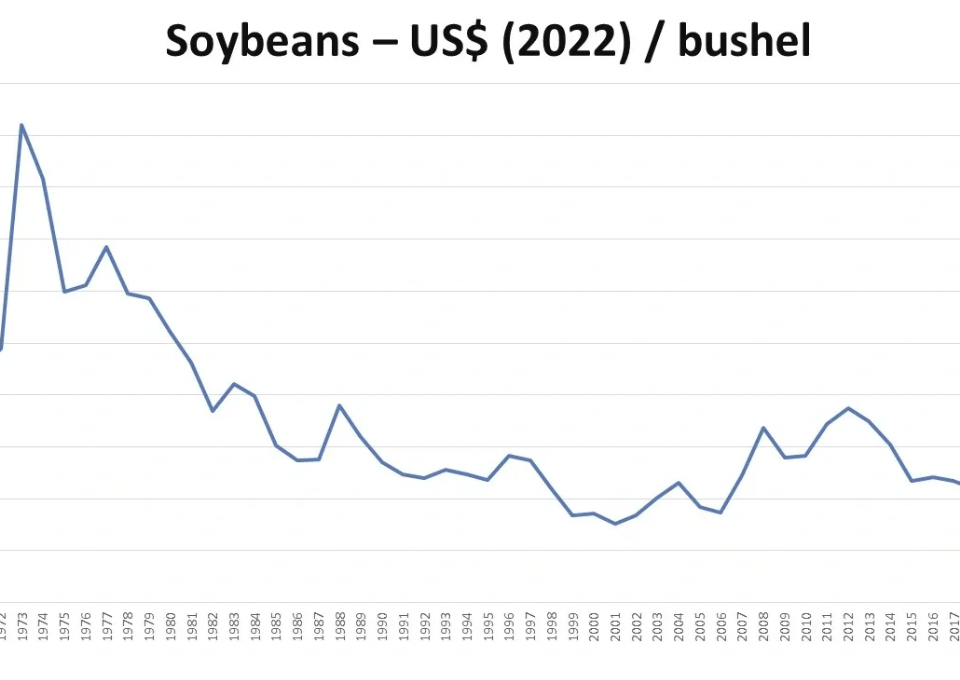

“Brazil is agro”. This has been the official propaganda. In some sense that is true, the Brazilian economy is quite dependent on agribusiness (and on mineral […]

April 4, 2023

Crunchbase recently published a list of US startup (venture-backed) exits — IPOs, Direct Listings, SPACs, and M&As — valued at $1B or more. Below are some of the statistics […]

March 25, 2023

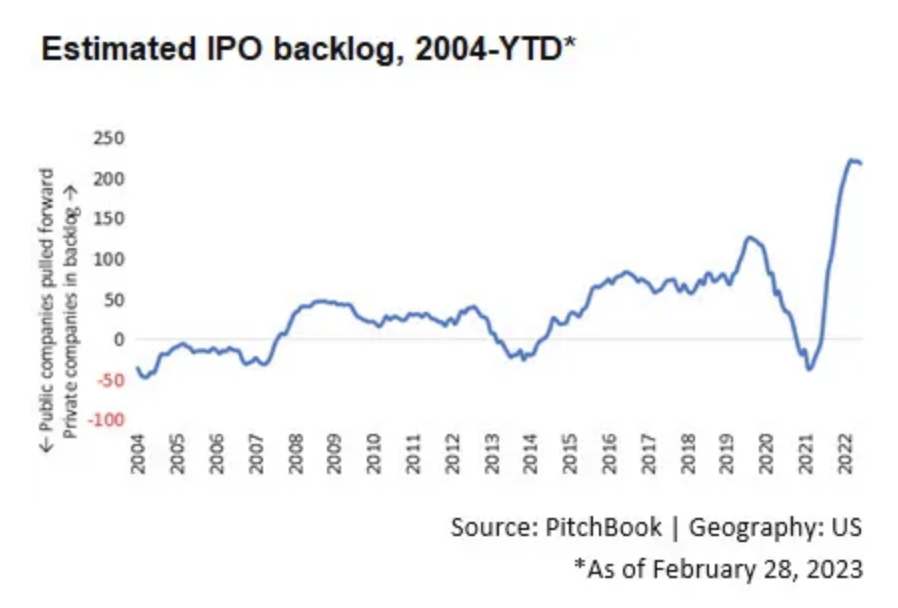

In 2021 there were 175 US VC-backed IPOs, while in 2022 this number dropped to 14 (Jay R. Ritter). What does explain the 2022 IPO window […]