Silicon Valley Will Shine Brighter

March 18, 2023

Exit Value to Funding Raised Ratio

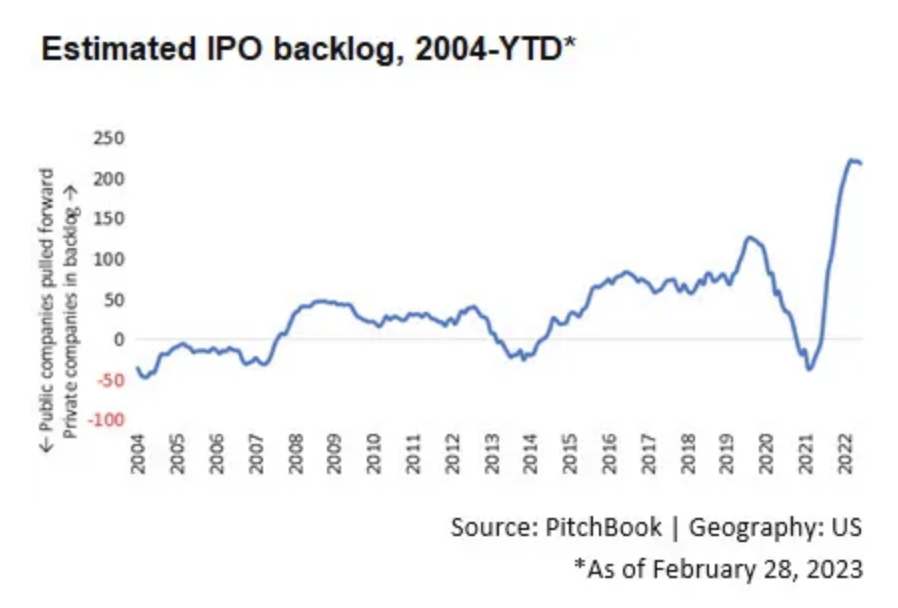

April 4, 2023In 2021 there were 175 US VC-backed IPOs, while in 2022 this number dropped to 14 (Jay R. Ritter).

What does explain the 2022 IPO window closing?

Elementary, my dear Watson. Interest rates went up from almost 0% in January 2022 to more than 4% in December 2022. Because of this, public tech valuation multiples collapsed by over 50%. Consequently, the public listing market was shut; better wait for higher multiples.

However, by the end of 2022 there were 650 unicorns in the US, and many of them are 10+ years old companies. Of this group, Pitchbook estimate that there are 219 ready to go public (pictured above, a high record number) but are stuck waiting for multiples to improve before taking the leap.

Indeed, there is a roster of blue-chip tech startups ready to go public: Checkr, Automattic, Tanium, Netskope, Flexport, Addepar, Carta, just to mention a few names, all of them part of Fabrica Ventures Fund I portfolio.

Conclusion

The most probable scenario is that the IPO window will continue shut during 2023-24.

But, après 2024, le déluge of tech IPOs.