Later Stage Conifers

August 10, 2019

Late Stage VC Four-Quadrant Investment Matrix

October 4, 2019Nassim Nicholas Taleb in his “Antifragile – Things That Gain From Disorder” describes an option as

Option = Asymmetry + Rationality

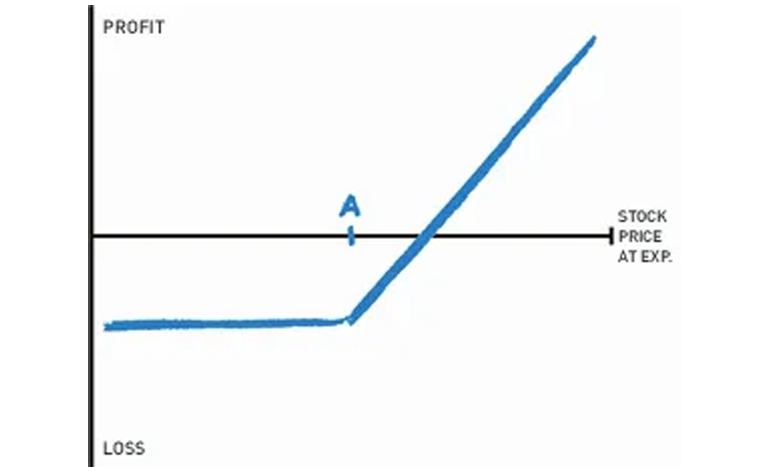

Asymmetry is a form of nonlinearity in which there is more upside than downside. If you are right, you “earn big time”; if you are wrong, you “lose small”; i.e., right hits bring large rewards while errors carry small costs. If you make more when you are right than what you lose when you are wrong, then you will benefit over time.

Rationality is the ability to cherry pick the best for yourself and ditch the bad.

Optionality is then the capability of identifying a favorable result and getting the right (but not the obligation) to exploit it.

Late Stage VC perfectly represents Taleb’s notion of optionality.

Technology VC thrives in an Extremistan world, where the winners usually enjoy an uncapped payoff.

Early stage VC funds strategy is thus to spread investment attempts across a large number of promising nascent ventures — it is more important to be in everything in a small amount ($) than to miss the winner that will take it all.

Late Stage is the natural step after the early stage’s evolutionary selection & radical clean-up; an alphas-only ecosystem club. And, like early stage, Late Stage also follows a power-law type distribution with big (but rarely extreme) upsides, however with very limited downsides.

According to PitchBook (1Q 2019), less than 5% of all billion-dollar-plus VC exits in the US since the start of 2010 have come at a valuation below the target company’s last private post-money valuation, with a median valuation step-up of over 1.8X. Full fledged asymmetry at work!

Moreover, if you manage to be rational and cherry pick well, Late Stage VC gains can be quite rewarding! Let’s see some examples of Late Stage last round returns of recently IPOed companies (by Aug/9/19):

Zoom Video = 2,467% (last round 32 months ago) — Extremistan also happens in Late Stage!

Slack = 119% (last round 12 months ago)

Medallia = 94% (last round 5 months ago)

Conclusion

Late Stage VC asset class offers…

1) Asymmetry –- more and larger upsides than downsides.

2) Rationality, which is provided by a cherry-pick approach (pledge format).

1) + 2) = Optionality checkmate!