Late Stage VC Optionality

August 12, 2019

What is Tech

November 4, 2019WeWork’s IPO failed miserably. It is now a zombie company with its carrion bonds being avidly shortened by WS hyenas.

Lyft’s stock is 45%+ down from its IPO price in March, even lower than its last private VC round.

Nonetheless, WeWork and Lyft dismal performances are good news! It proves, once again, that Sir Isaac Newton was right: gravity does indeed exist!

Human beings suffer from all kinds of judgement biases. Daniel Kahneman masterfully described this behavioral phenomenon in “Thinking, Fast and Slow”. We have a fast energy-saver mental system which operates as a machine for jumping to conclusions — WHAT YOU SEE IS ALL THERE IS (WYSIATI). This lazy and low-effort intuitive mental mode, in conjunction with the anchoring effect, make people easily and automatically accept that, since high-caliber investors poured billions into a company, it is worthy and probably worth more.

On the other hand, there is a limit that business analysis can reveal. Some consulting firms, for instance, believe that if you intensively spank a spreadsheet it will ultimately tell you the truth and generate a kind of Buddha’s enlightenment. They forget that consumers are actors with volatile volition.

Here I think that the “virtue lies in middle way”. To invest blindly in a company, in an asset class or in a country’s frontier, just because others are doing it or because naïve formulas (“The Black Swan: The Impact of the Highly Improbable” is a good reading on that) state that it is cool to openly diversify, is not a sign of wisdom, instead it is a sign of Joneses’ herding. At the same time, to over-analyze can configure a sign of lack of business acumen or of a personality trait (a perceiving type in Myers & Briggs).

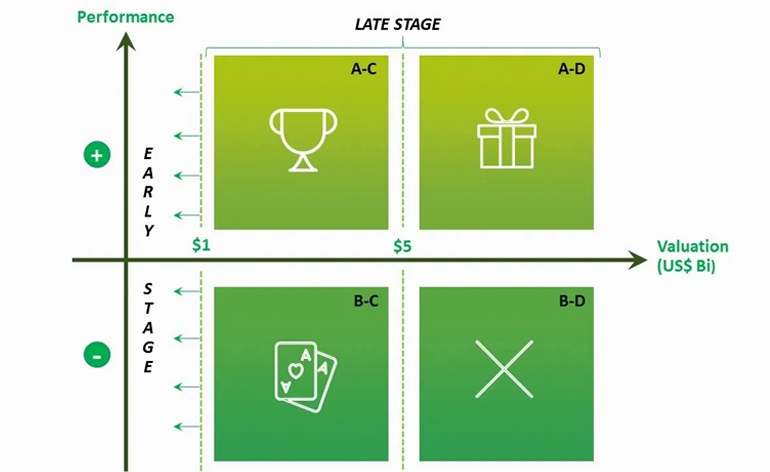

We have been using a “Four-Quadrant Matrix” to guide our investments in Late Stage VC.

Y axis: Performance (a basket mix of Compelling Business Model, Technology Stack, Pathways to Profitability, Margins Evolution, Cash Cushion, Governance Practices, etc) — divided in more developed (A) and less developed (B).

X axis: Valuation (proxy for up-side potential and easiness for IPO) — divided in US$ 1-5 billion (C) and greater than US$ 5 billion (D).

The Sweet Spot Quadrant is A-C: 23andMe, Coursera and Flexport are in this quadrant. Zoom Video, DataDog and PageDuty were there too, before their IPOs. High probability of a very high return: 40%+ IRR.

The Gift Quadrant is A-D: Airbnb ad Stripe are in this quadrant. Very low probability of losing money. Best risk-return in town: 20%+ IRR.

The Poker Quadrant is B-C: Brex and Affirm are in this quadrant. The differentiation is there, the team is there, the momentum is there, but still burn cash. Fair chances for extraordinary returns. Losses may happen, but rarely a write-off.

The No-No Quadrant is B-D: WeWork is in this quadrant and Lyft was there. Any market hiccup can really damage your investment odds. High probability of a Ponzi merry-go-round puff nightmare.

Conclusion

There is art in investing.

But talent and luck are not sufficient.

Method and hard work are also necessary.