Do VC-Backed IPOs Perform Better?

December 4, 2021

Cerebras Systems: The World’s First Wafer-Scale Processor for AI

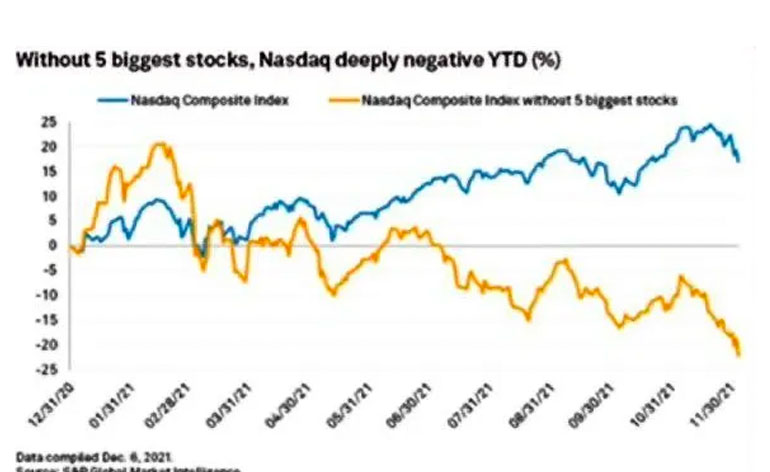

December 28, 2021By excluding the 5 biggest stocks – Apple, Microsoft, Amazon, Google and Facebook – the Nasdaq Composite Index is in bear market territory in 2021, with a drop of about 25% in the year (see figure above).

Even though it may look odd, this can be good news for Fabrica Ventures.

When we decide to invest in a tech late-stage venture, we perform a sensibility analysis of the expected returns using, as reference, revenue multiples of Nasdaq listed ‘comparables’. At the private market stage, revenue (size, recurrency and growth) is the most relevant metrics, since VC capital is mostly deployed to foster growth and develop new innovative products, as opposed to PE capital (or more precisely, PE debt) which goal is usually to squeeze costs and improve the bottom line to leverage down the balance sheet.

So, for instance, we contrasted Tanium against Crowdstrike’s multiples, Netskope against Zscaler’s, Sift against Riskified’s, and so on. In a few cases, however, the comparables are not evident – Checkr and Dataminr, for instance, are creating new markets for themselves.

Returning to the main point, why is it good for Fabrica Ventures that Nasdaq multiples have been dropping?

Because we are in the investment period.

With Nasdaq comparables’ multiples down, our valuations (which are based on these multiples) naturally go down and thus we forcefully become more conservative in the investment decision. If a portfolio investment is approved in this more acid (in terms of multiples) scenario it is because it is indeed a more solid opportunity.

Conclusion

There is always a bright side in any ‘bad’ news.

We have up to four years to exit our investments.

It can be a pleasant surprise if, during this period, Nasdaq multiples return to the levels of the end of 2020. Otherwise, the present levels shall be good enough since we have been taking advantage, in a disciplined way, of the present lower multiples.

Like Magnus Carlsen, time is on our side and we are prepared for long games if necessary.