The Winner Takes It All

November 26, 2021

Good or Bad News?

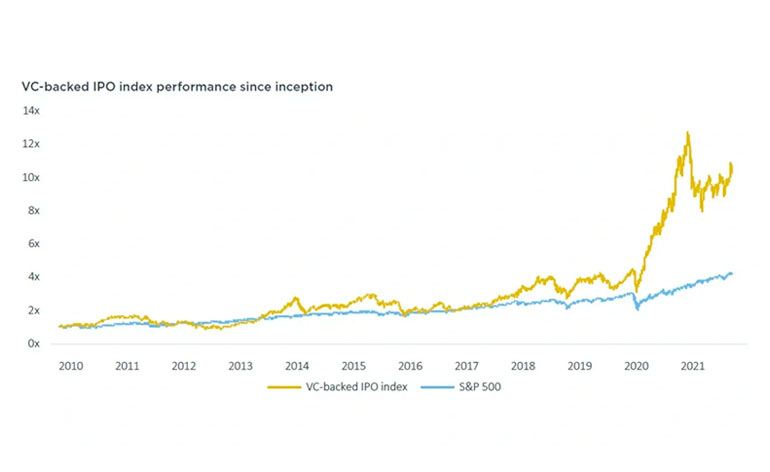

December 11, 2021Pitchbook recently tried to answer this important question for investors in general in the article “Index of Venture-Backed IPOs”: do VC-backed IPOs perform better than the S&P 500? Or, in other words, do they hold up during the post-listing?

To analyze this, Pitchbook considered VC-backed listings on the NYSE and Nasdaq, regardless of the company headquarter location (e.g., the Brazilian VTEX is in the index). The newly listed VC-backed companies are only included in the index in the first day of the quarter after the IPO and continue in the index until the first day of the quarter after they have been trading for two years. Thus, by construction and importantly, the first-days pops are not incorporated in the Pitchbook Index – to grasp the potential impact, the first-day pops reached 41.6%! in 2020.

Now, on November 23, 2021, the Pitchbook Index is composed by 310 VC-backed companies, with the largest 25 representing 70% of the index weight (Palantir, a Fabrica Ventures investment, is the 9th). Moreover, software companies respond for 45% of the index weight.

The takeaways are:

1) From 2010 to the onset of the pandemic in Feb 2020, the Pitchbook Index had an accumulated performance 50% better than the S&P 500

2) From then to now, the Pitchbook Index experienced a spectacular performance growing 130% while the S&P grew 40%

3) In 2021, however, the Pitchbook Index grew only 1% (dropping from +24% in February) while the S&P grew 25%. Even though 2021 (until the end of Q3) has been a record year for VC-backed companies in the public markets – with 221 IPOs and $513 billion in deal value – the threats of rising interest rates and the Omicron selloff are disproportionately affecting the tech market. Looking forward, monetary policies uncertainties, to fight price inflation, loom over a huge unicorns’ inventory / IPO backlog — almost 400 in the US alone.

Conclusion

The performance of the VC-backed IPOs has been consistent and superior to the S&P 500.

This is an encouraging sign for the VC ecosystem. It is good to know that value creation continues in the aftermarkets.