Late Stage VC Goes Mainstream

September 18, 2020

Startups CEOs’ Skin in the Game

December 6, 2020SaaS business model is subscription-based. Subscriptions promote revenues’ stickiness. SaaS companies are typically B2B and operate with high gross margins, in the 70-80% range. In addition, cloud software can be remotely distributed, not requiring on-premises installation, which is perfect during Covid times.

Most SaaS companies going public are not generating cash, because they are growing 30-40% per year and clients’ acquisition is costly. However, if SaaS companies stop investing in growth, they will quickly become profitable. Given this economics, SaaS investors are mostly speculating in the long-term potential for future cash flows.

Thus, since most SaaS companies are still in the phase of quickly building up their subscribers’ base, they are traded on revenues multiple instead of earnings multiple — the most common one being enterprise value (EV) over the next 12 months (NTM) revenue. Ultimately, the high revenue multiples of SaaS companies today — in the range of 20-30x NTM revenue — are proxies for the future earnings streams and cash flow generation.

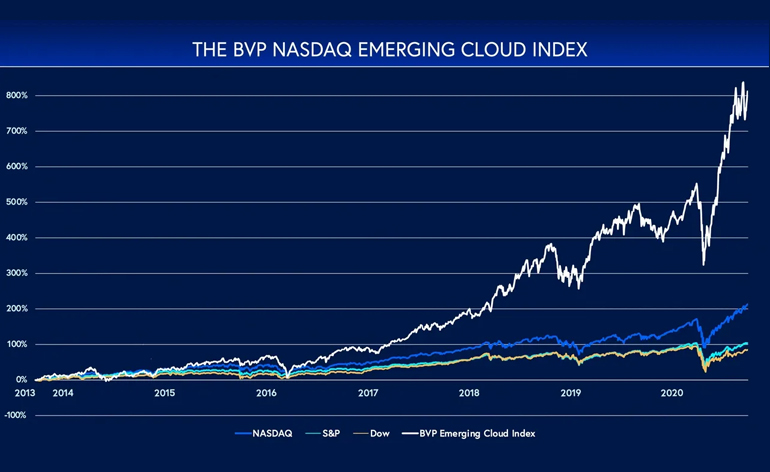

Public market investors (even Warren Buffet with Snowflake) have recognized how big the market opportunity is and are allocating more of their portfolio towards SaaS companies. These investors rightly believe that the tech transition to the cloud is only getting started.

Hence, looking at the recent wave of SaaS IPOs, it is of no surprise that investors are willing to pay high multiples. For instance, Palantir, a Fabrica Ventures late stage investment, went public in Sept/30/2020 getting an EV of $15.2B. Fifty days later, in Nov/19/2020, Palantir’s EV more than doubled to $32.0B, representing a 25.5x EV/FY21 revenue multiple. This multiple is still “shy” in comparison with other SaaS companies: Coupa Software = 34.7x; Cloudflare = 32.1x, DataDog = 31.0x, and so on.

Obviously, markets can change at any time. If you are investing at the growth stage (IPO perspective in 2-3 years), the best antidote to market fluctuations is a deep due dil in order to cherry pick the SaaS companies with superior and improving metrics: Annual Recurring Revenue (ARR), upsell, churn, and sales efficiency. In addition, you can consider that a SaaS company is ready for IPO after reaching $150M of ARR.

Conclusion

SaaS is quite a new business model — SaaS companies have been around for only 15 years, and there are no more than 75 public pure play SaaS companies.

In the last 3 years, the average return from IPO price for standalone SaaS companies is about 5x. Just imagine the late stage investors’ returns!