Fabrica VC

Insights from Fabrica Ventures Team.

February 22, 2026

CB Insights has just released its 2025 global “State of Venture” report. Two statistics in particular stood out to me: 1. The US share of global […]

February 15, 2026

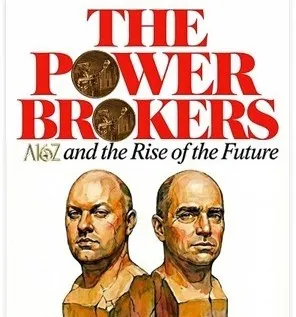

Packy McCormick published a long essay, The Power Brokers — a16z and the Rise of the Future, in January 2026, just as a16z raised a massive $15B […]

February 8, 2026

Legal tech has become one of the most dynamic verticals in VC over the past three years. For decades, legal research operated as a comfortable duopoly […]

January 28, 2026

Ten days after the announcement, the Brex sale to Capital One for $5.15B has generated a flood of coverage. It now stands as the largest exit […]

January 23, 2026

After a three-year freeze, crypto companies are quietly returning to the IPO market. This shift is not speculative — it is structural. Regulation and enforcement-by-lawsuit have […]

January 15, 2026

A Fabrica Ventures é um fundo de VC late-stage levantado e liderado por GPs brasileiros, sediado no Vale do Silício e que investe diretamente em B2B-tech […]

January 12, 2026

In the US, the PE (or LBO) asset class is over three times larger than VC in terms of dry powder. Structurally, PE targets mature, low-growth, […]

January 5, 2026

There is no crystal ball. Human action arises from trillions of independent decisions — far too complex to simulate — ideally made voluntarily and coordinated through […]

December 28, 2025

On Christmas Eve, Nvidia (market cap ~$4.6T) announced the acquisition of AI chipmaker Groq for around $20B in cash (the exact terms are still not public), […]