Serial Entrepreneurship

September 8, 2022

A Good Omen

October 14, 2022SaaS companies are usually measured against the Rule of 40: the idea that growth rate plus profit margin should exceed 40%. It is an important metric because it sheds light on the trade-offs of balancing growth and profitability.

Brandon Gleklen, a Battery Ventures partner (in portfolio I, Fabrica Ventures invested alongside Battery in Next Insurance, Carta and InVision), noticed that even though the Rule of 40 is a quick and “fine metric but, by definition, it weighs growth and profitability equally. In different environments, investor weighting can be quite different”.

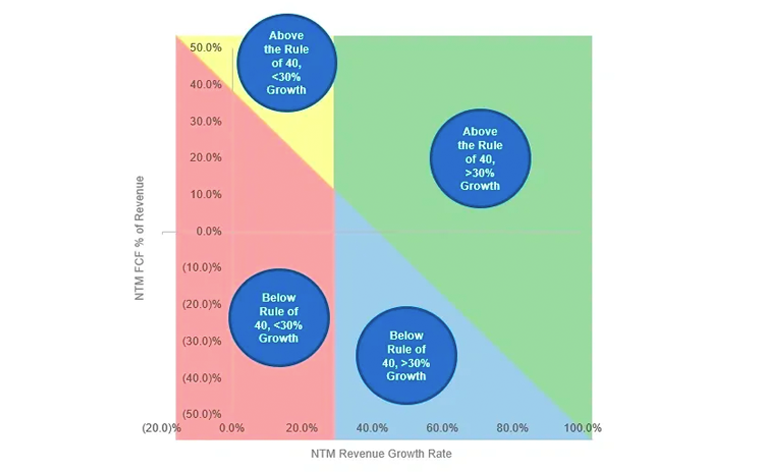

So, in order to address this point, instead of having the usual two Zones, +/- Rule of 40, Gleklen added more two Zones by splitting revenue growth at +/- 30% — NTM (next twelve months) projections were employed for both revenue growth and profit margin (FCF).

Gleklen then named each Zone by a color (depicted in the figure above):

Green: Above the Rule of 40 and > 30% growth

Blue: Below the Rule of 40 and > 30% growth

Yellow: Above the Rule of 40 and < 30% growth

Red: Below the Rule of 40 and < 30% growth

Finally, based on public SaaS companies’ data, he calculated the median valuation revenue (NTM) multiples on four dates: end of 2019, end of 2020, end of 2021, and March 2022

Green: 15.2x; 34.3x; 21.5x; 18.2x

Blue: 12.8x; 30.6x; 19.7x; 8.9x

Yellow: 10.3x; 18.2x; 15.0x; 11.2x

Red: 6.6x; 11.6x; 7.2x; 5.5x

Conclusion

1) Overall, after the 2020 spike, SaaS valuation multiples went down and now are at 2019 levels

2) The multiple variance in each zone can be huge (not shown above). For instance, in the Blue Zone – March 2022, the highest revenue multiple was MongoDB at 24.9x and the lowest was WalkMe at 3.7x.

3) Until the end of 2021, fast growing companies below the Rule of 40 (Blue) were valued more highly than slow growing companies above Rule of 40 (Yellow), i.e., growth outweighed profitability. But this has changed with the present environment of rising interest rate; more focus is being put on profitability.

4) Companies in the Yellow Zone usually show more traditional business models (Salesforce, Intuit, Adobe, Paycom, ServiceNow, …) while companies in the Blue Zone show new-flavored business models (Toast, Confluent, Asana, Marqeta, Unity, …).