ShipBob: The Platform Powering the New Right to Two-Day Shipping

December 1, 2025

An AI Wall for Management Consulting?

December 14, 2025Back in 2020, when Fabrica Ventures began, secondaries were considered a niche strategy. Fast-forward to today, they have become an essential tool for portfolio management in private capital allocations.

The main driver is straightforward: as funds approach or surpass their 10-year lives, their winners often remain illiquid, leaving most returns visible only on paper. Investors are therefore increasingly turning to the secondary market — frequently the only viable source of liquidity — to realize those gains and deliver DPI (Distributed to Paid-In Capital), the metric that truly matters while funds are still active.

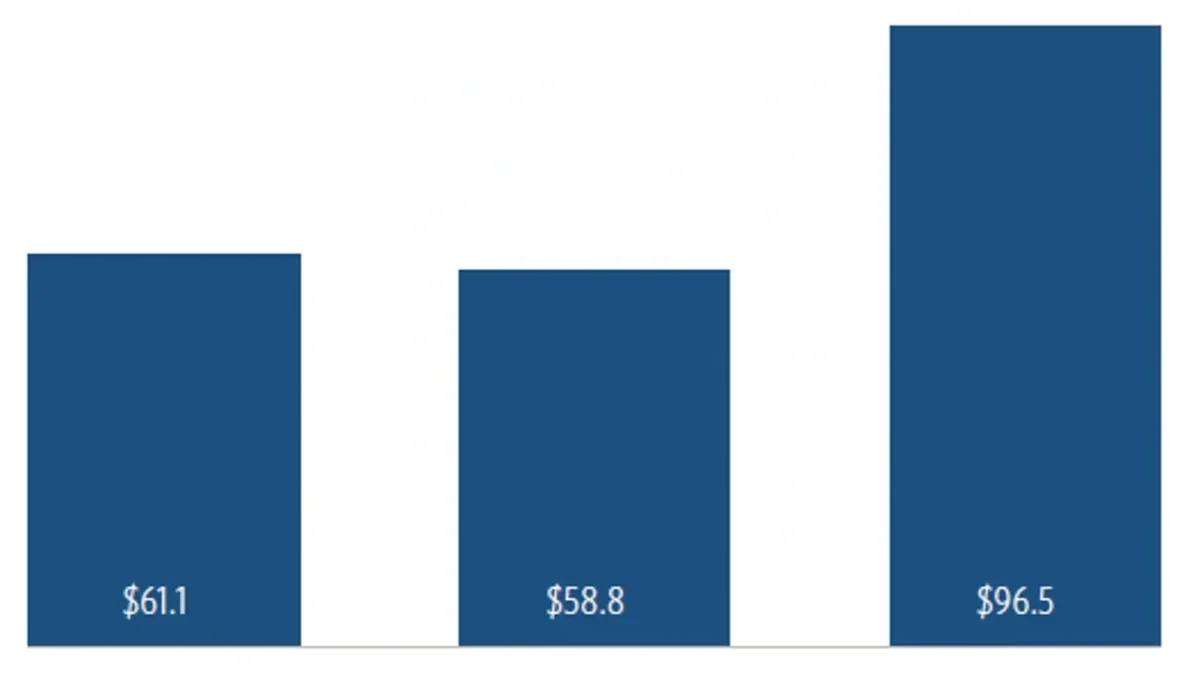

Consequently, secondaries are ripping across the board (all data from PitchBook):

* Over the 12 months from Q3 2024 to Q2 2025, the US VC direct secondary market is estimated to have transacted $61.1B—substantial in absolute terms, yet still far short of meeting the liquidity needs of the broader venture ecosystem, which holds roughly $3.3T in aggregate unicorn valuations

* This amount equals 32% of total VC exit value and has already overtaken public listings as an exit channel

* Secondaries are heading toward a record fundraising year in 2025, despite fewer funds coming to market. Only 42 vehicles have raised capital so far, versus a five-year average of 127

* Venture secondary dry powder has more than doubled since 2022, climbing to $8.2B by December 2024. Yet dedicated secondary capital — such as Fabrica Ventures’ — still accounts for just 2.9% of the dry powder available to primary VC funds

* The rise of SPVs has also helped boost secondary volumes. Traditional secondaries typically trigger ROFRs and can be blocked by company boards. SPVs bypass this friction because investors are not transferring shares directly on the company’s cap table. Moreover, institutional investors are increasingly willing to embrace the SPV structure, given that the alternative is often missing out on exposure to perceived generational companies

Conclusion

VC secondaries have come a long way.

We are grateful to our LPs for the opportunity to thrive in this (now-ripping) market.