Menlo Security

December 10, 2023

Goldilocks Scenario for US VC

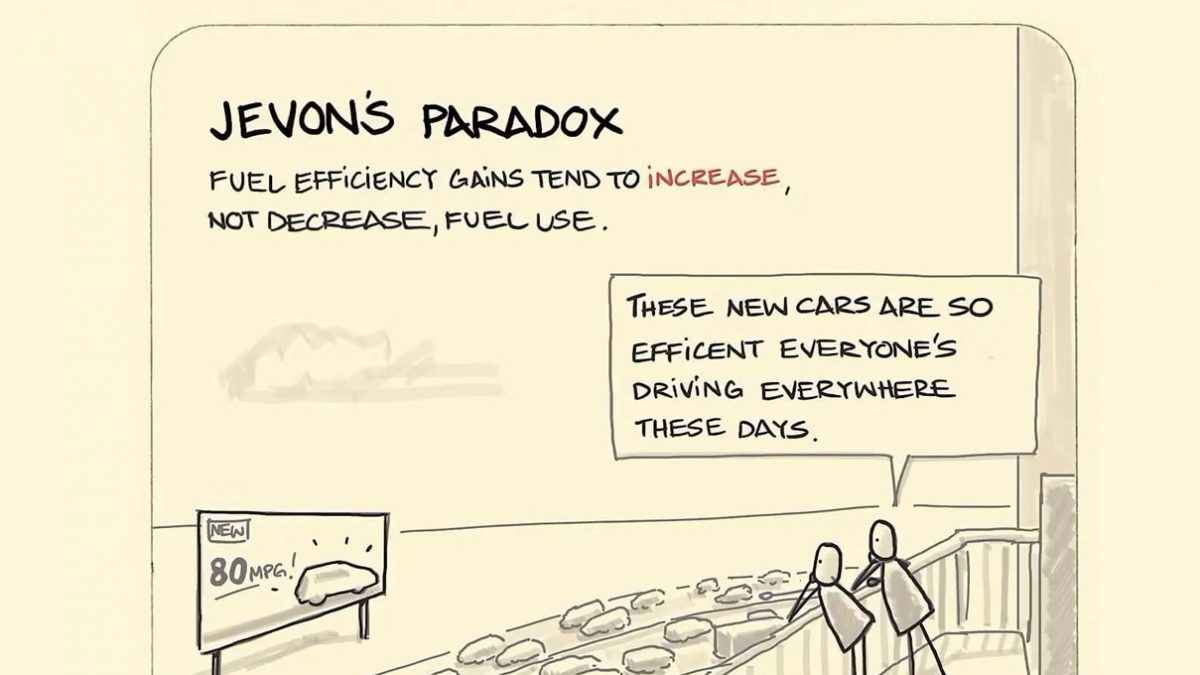

December 24, 2023“It is a confusion of ideas to suppose that the economical use of fuel is equivalent to diminished consumption. The very contrary is the truth.” — William Stanley Jevons (1865)

This is known as the Jevons paradox, a “counterintuitive” observation that as technological improvements in efficiency lead to a reduction in the use of a resource per unit of output, it may “paradoxically” result in an overall increase in the consumption of that resource (elastic demand, in economics terms).

Microchips (miniaturization) and the internet (data compression) are well-known cases of Jevons paradox. Indeed, because their marginal costs have dropped (and continue to drop) so much, consumption has increased (much) more than proportionally.

AI is on the same Jevons path away. Many industries will change entirely, the economics are just too compelling — just compare, for instance, a customer care cost via an AI ChatBot vs. of a human (I will not address the hidden values of human relationships here).

So, unsurprisingly, we are witnessing a new gold-rush into AI startups. US VC AI investing is thus breaking records — a few of “n” examples:

* Funding for AI-related US startups reached $68.7 billion in 2023 (Sept 30th)

* Menlo Ventures closes on $1.35B in new capital, targets investments in AI startups; Sapphire Ventures plans to invest over $1B in enterprise AI startups; Sound Ventures closes oversubscribed AI fund at $240M, and so on

But will this momentum endure?

There is little doubt that we are getting ready for a new wave of iconic companies, as happened with the internet.

However, building an AI startup, both in generative and in application fields, is of course hard.

And even a Menlo Ventures (which is in the forefront of VC AI investing) partner is cautious about the US AI deal-making mania: “In hype cycles, you have the innovators and then the imitators and then the idiots—and that is the sequence in which these things go. We are still at the innovators’ part of the cycle.…But we’re slowly starting to see imitators emerge—and we’ve not yet seen idiots emerge.”

Conclusion

In software, the infrastructure market is typically of the same size as the applications market, the main difference is the concentration: a few to many, respectively.

At Fabrica Ventures, we decided not to invest in AI infrastructure, i.e., GenAI – the multiples are too high, the capital needs are colossal and further meaningful dilutions are certain.

Instead, we decided to continue investing in leading and established software application startups (at reasonable multiples) that are incorporating AI in amazing ways.