A heuristic (from the Greek ‘I find, discover’)

March 7, 2021

Our First Exit

April 3, 2021Venture Capital and Private Equity funds (VCs-PEs) are ‘closed end’, since they deal with illiquid assets, i.e., equity in privately held companies. Because VCs-PEs cannot sell private company shares in a fingers snap, investors in VCs-PEs cannot freely withdraw their capital. And because closed-end funds cannot lock up investor capital forever, they have a limited lifespan – 10 years being the standard.

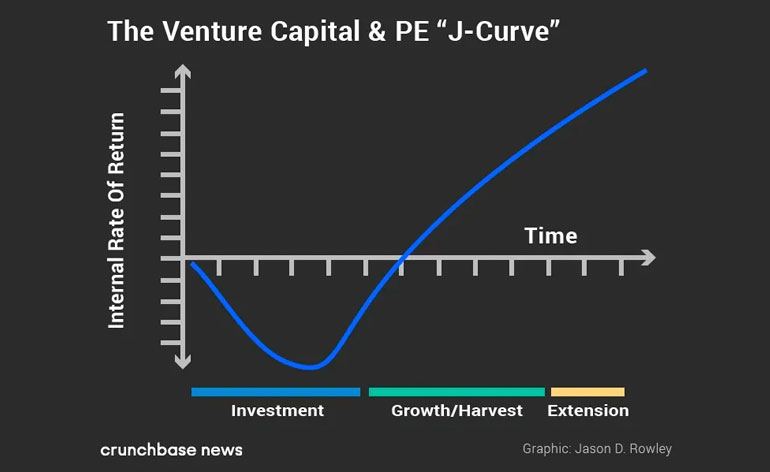

In practice, it means that VCs-PEs have generally poor financials for the first years of existence. This phenomenon is known as the J-Curve, after the shape of returns over the life of VCs-PEs.

Detailing the reasons for the J-Curve:

* Fund organizational expenses. Funds are expensive to form. Formation expenses include legal, accounting and taxes and it is customary for the fund to reimburse the fund’s GP for these initial organizational expenses.

* Management fees. The fund pays the GP a management fee, which is usually 2% of committed capital each year.

* Fund expenses. The fund also has annual expenses that it pays, including insurance, accounting fees, legal fees, back-office fees, brokerage, etc.

* Portfolio valuation. There is a saying, particularly in VC, that ‘lemons ripen early’ or ’lemons ripen faster than pearls.’ This refers to the fact that poor investments are often recognized by the GP early (when an investment sours, the GP writes-off its carrying value), while good investments typically take a longer time to mature. The J-Curve tends to be more pronounced in early-stage VC funds, where around 30% of the investments are expected to write-off.

In Fabrica Ventures fund’s pitch presentation we wrote a section of ‘Why Late Stage VC.’ Among the reasons we highlighted: “J-curve smoother: Early Stage VC funds usually have a pronounced J-curve; the “lemons” ripe early and the winners take time. Late Stage VC funds, on the other hand, do not hold the J’s belly, since they have a faster turnaround and hardly carry sour fruits”.

We just prepared Fabrica’s first tax returns and, to our surprise, there was no J-curve; the ending balance closed higher than the total contributions amount (on a GAAP basis). Besides being lucky with the prompt Palantir’s IPO and its impressive appreciation, we have always been frugal with the fund costs, even though we chose the best fund admin and legal services providers.

Conclusion

It feels good not to show any belly at all.