AI Supercycle in Motion

June 29, 2025

Fully Depreciated in One Year! & A Tax Break Looking for a Buyer

August 1, 2025Although Silicon Valley grew alongside the defense sector, the two have drifted apart since the Internet boom of the 1990s. With the military reliant on sluggish traditional contractors, there is now an urgent need to transition to autonomous warfare — Ukraine serving as a proving ground.

The ten largest defense contractors — known as the primes, including Lockheed Martin, Raytheon, and Northrop Grumman — account for over 80% of all aerospace and defense revenues. These incumbents benefit from vast scale and significant political influence. The primes operate under the traditional cost-plus contracting model, which offers little incentive to innovate quickly or reduce costs. Their products are typically tailor-made, one-off systems built to exact government specifications, rather than adaptable, commercially driven solutions.

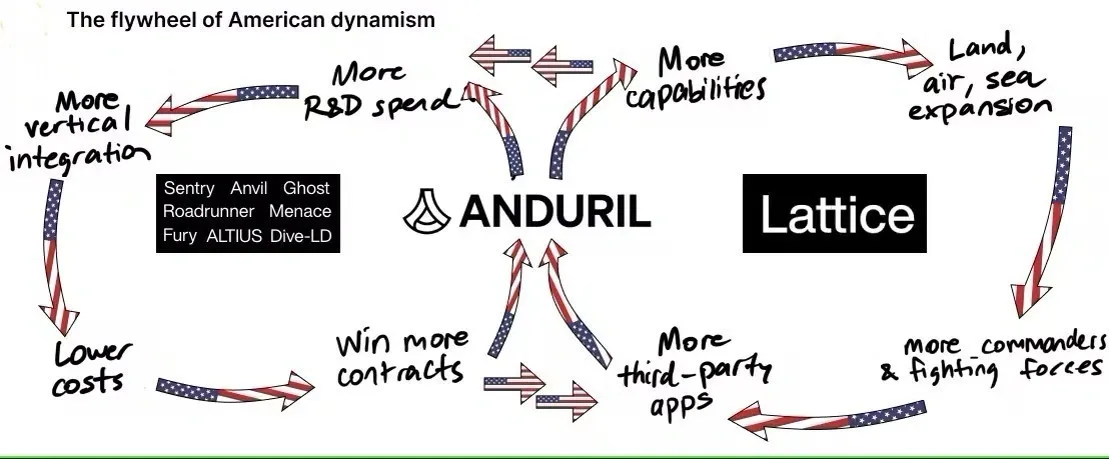

A wave of new defense startups is aiming to transform the US military by focusing on autonomous systems and investing heavily in upfront R&D. Among them, Anduril stands out as the best positioned to become the next prime.

At the core of Anduril’s product suite is Lattice, an AI-powered software platform that integrates data from a wide array of sensors and systems to deliver real-time situational awareness and data-driven decision-making. Lattice is built to ingest vast amounts of information and apply ML algorithms to simultaneously detect, identify, and track multiple targets simultaneously. Lattice is offered as a subscription-based service, with customers paying a recurring fee to access its capabilities, including object detection, tracking, and data fusion.

To augment Lattice, Anduril has developed a series of other hardware products, including:

* Anvil: a kinetic counter-drone system deployed on the ground

* Ghost 4: autonomous tactical drone assembled in 3 min that can fly silently for 60 min

* Altius: a drone with 4 models that can deploy from air, land, and sea

* Dust: a ground-based sensor that detects and alerts users of targets

* Dive-LD: autonomous underwater vehicle that can run surveillance at up to 6,000 meters

More recently, in January 2025, Anduril unveiled a $1B initiative to build “Arsenal-1,” a hyperscale autonomous weapons manufacturing facility in Ohio.

Anduril hit $1B in revenue in 2024, marking a 140% increase over 2023, driven by a surge in new government contracts that exceeded $1.5B for the year.

Conclusion

Anduril’s latest funding round in June 2025 raised $2.5B at a $30.5B valuation, bringing total capital raised to $6.5 billion. The round was led by Founders Fund, which committed $1B — its largest single check to date. Investor demand exceeded supply by an estimated 8-10x, and secondary trading remains tightly restricted under company policy.

Fabrica Ventures is proud to count itself among Anduril’s investors.