Let’s Go Andrew!

October 17, 2025

Fabrica Ventures Featured in CB Insights Case Study

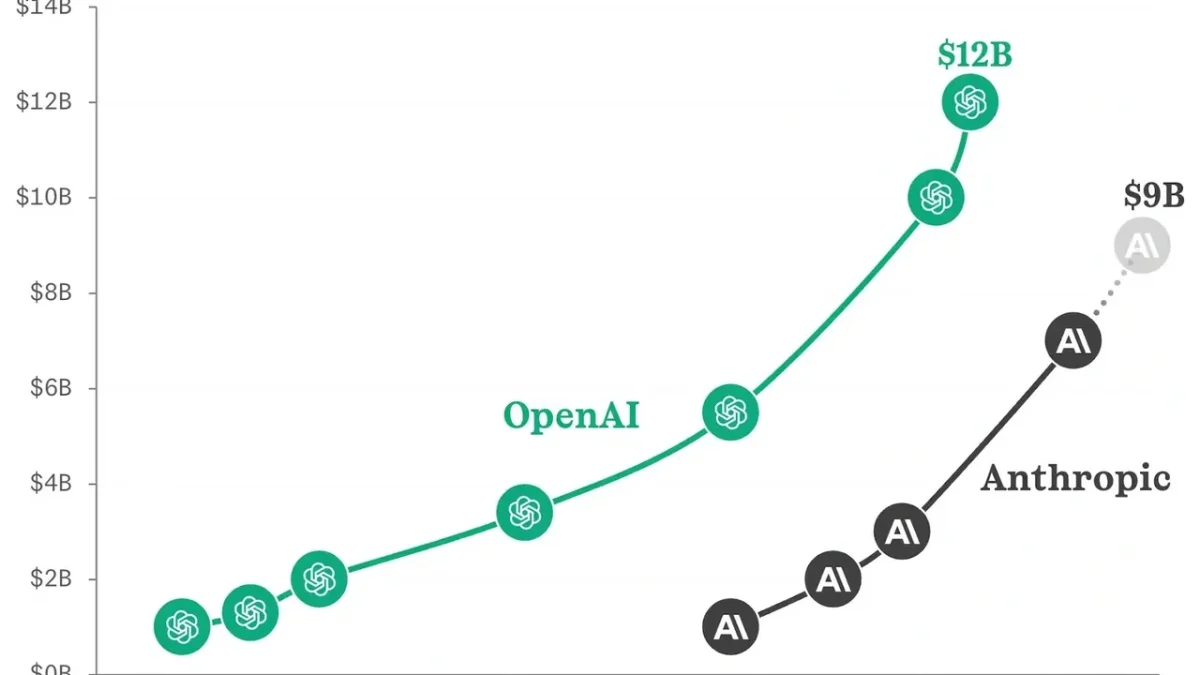

November 1, 2025Anthropic (founded in 2021) closed 2024 with $1.0B in annualized revenue and a $62B valuation, implying a 62x revenue multiple at the time of Fabrica’s investment.

In September 2025, the company raised $13B at a $183B valuation. Remarkably, its annualized revenue is expected to reach $9B by year-end 2025, bringing our revenue multiple down to just 7x — a powerful illustration of how rapidly AI fundamentals are catching up with valuation.

OpenAI has already reached $12B in annualized revenues.

For perspective, Google (founded in 1998) — arguably the most successful company of the previous tech cycle (the Internet era) — went public in August 2004. It closed that year with $3.2B in revenue, which then surged 93% in 2005 to $6.1B, and a further 73% in 2006 to $10.6B.

Thus, both Anthropic and OpenAI are expanding at unprecedented speed and scale, leaving even Google’s early growth years in the dust.

Of course, there were excesses in the dot-com era, and there will be excesses in the AI era — as there always are at the dawn of every tech super cycle.

Even setting aside Anthropic and OpenAI, the pace at which AI startups are hitting $100M in ARR is truly unprecedented — with companies like Cursor, Glean, Synthesia, Suno, Replit, Harvey, Lovable, and Mercor, among others, reaching that milestone at record speed (so high multiples should come as no surprise).

We already have a relevant public benchmark for AI infrastructure in CoreWeave. With shares trading at roughly a 19x revenue multiple, it’s not a valuation that, by itself, would justify calling this a bubble. Moreover, one datapoint hardly defines a bubble.

Meanwhile, the MAG 7’s capital expenditures are projected to climb to $379B in 2025 (up from $156B in 2023), still representing only 66% of their operating cash flow — a sign that spending is aggressive but not reckless. And yes, circular financing deserves its own post.

By contrast, in physical AI — robotics — valuations are truly bonkers, since most of these startups generate little to no revenue yet. We took a hard look at Figure AI and decided to let it pass.

Conclusion

The Fed’s reckless money printing is lifting virtually every asset class — and AI is no exception.

That said, Nvidia, the world’s most valuable (AI) company, grew its revenues from $27 billion in 2022 to an estimated $200 billion in 2025 — not exactly the behavior of a company without fundamentals. Moreover, as noted earlier, most of the MAG7’s AI capex is being funded by operating cash flow, not debt (Oracle and IBM, outside the group, were already leveraged before AI). So, to me, it’s hard to see clear signs of an “AI bubble.”

Indeed, we are seeing a boom in AI venture investing — not a bubble, as it is driven by transformative economics and the fact that funding platform shifts is exactly what VC is built for. Yet today’s deployment still pales in comparison to 2021, reaching only about 60% of those levels. As always, the power law rules: a handful of standout AI companies will drive the vast majority of returns, while many^2 will fade.

We are confident we have chosen the right ones.