Why AI Will Save the World

July 11, 2023

VC Philosophy Pendulum

July 29, 2023Wiz cloud security was the fastest startup ever to reach $100 million in ARR, scaling up to this level in just 18 months.

Next, in Feb 2023, Wiz was valued at $10B, fetching a 100x ARR multiple.

In 2020-21, a 50-100x ARR multiple was kind of a benchmark in the VC industry — particularly in series A deals; startups with low-six-figure revenues were commonly priced as if there was no forward execution risk.

These record high multiples were supported by zero-interest-rates and by a stimulatory macro environment. Moreover, rosy business plans at 100%+ CAGR would quickly dip ARR multiples to low two-digits – indeed, Wiz has already doubled revenue since its last round, and it is now a 50x ARR investment.

In fact, many promising startups captured 50-100x ARR multiples – Snyk, Postman, Retool, Databricks, Snowflake, to cite a few. Besides enjoying high growth rates and being in high growth markets, these 100x ARR startups share some traits: high gross margins, high switching costs, little customer concentration, development of tech moats, presence of network effects, etc.

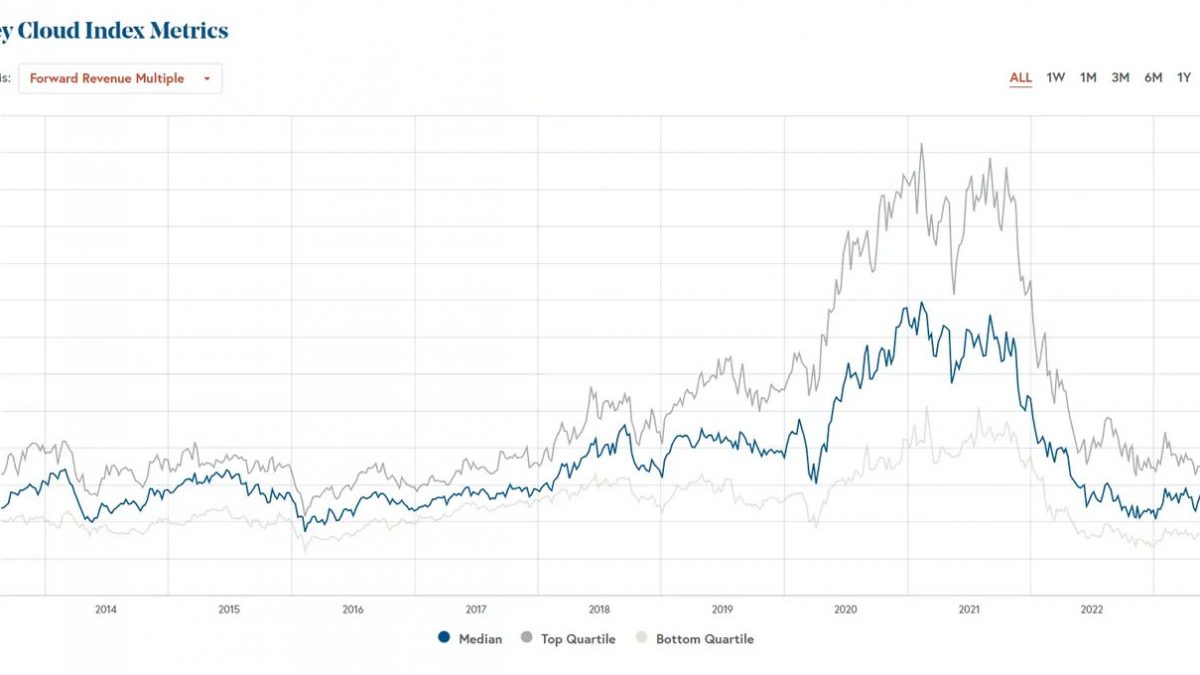

After the hiking interest rates shock coupled with recession fears (which led businesses to tighten their budgets), the average Cloud-SaaS revenue multiples of public companies dropped from the record levels of above 20x to 8x (graph above).

Following the public markets’ multiples adjustment, late-stage VC prices have also “normalized”.

Conclusion

We, at Fabrica Ventures, think that the valuation pendulum went too far to the other side – it was not just a regression to the mean, the reset went below long-term averages. And mainly now that AI is accelerating value creation in the cloud economy.

So, we see this present moment as a great opportunity to buy great startups at great prices.